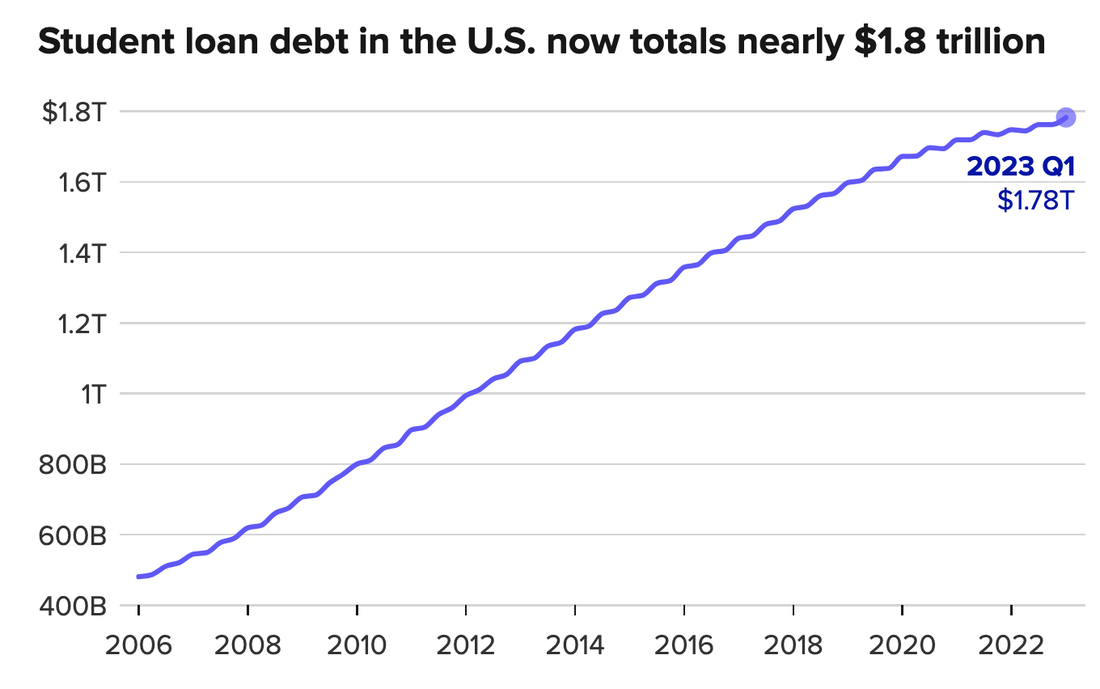

STUDENT LOAN DEBT HAS REACHED $1.78 TRILLION

We have to act now to address the immediate needs of borrowers and fix the failed policy experiment of debt-financed higher education. Over 45 million Americans owe more than $1.7 trillion in student loan debt. For millions of individuals and families, the higher education debt burden is crushing. Student debt means the delay of countless dreams—buying a house, starting a family, building a business. This crisis is disproportionately shouldered by Black, Indigenous, and people of color (BIPOC) and continues to worsen economic inequality.

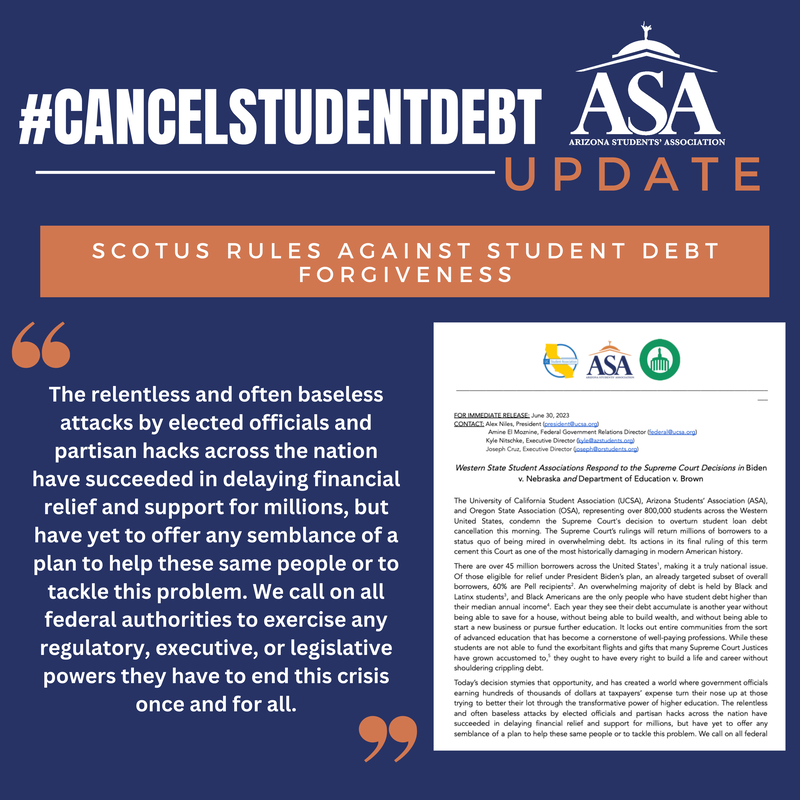

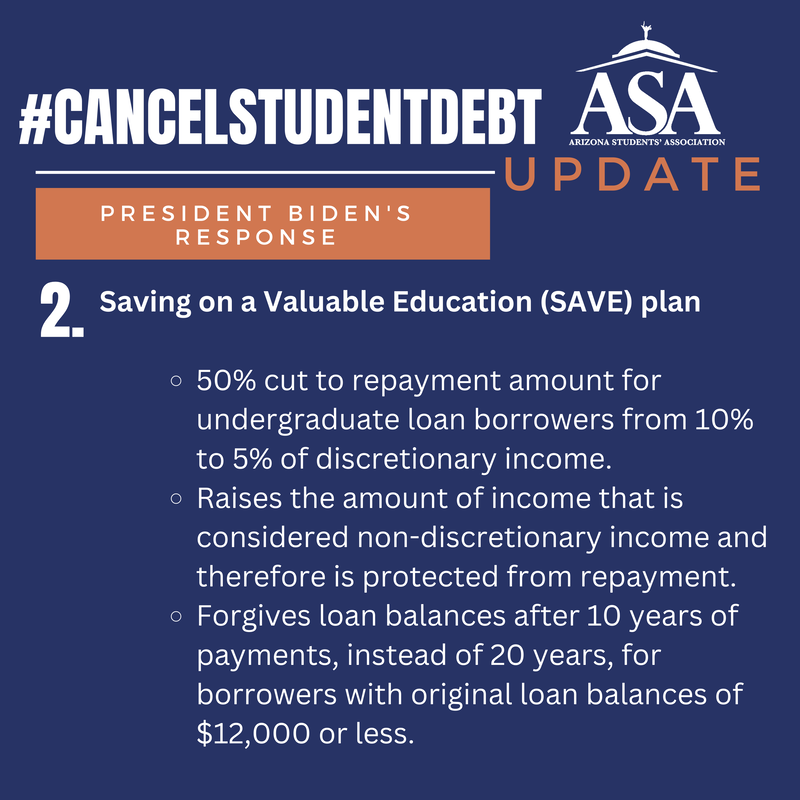

We have successfully engaged three presidential administrations, congress, and state legislators to address this crisis by shifting the narrative to include broad-based debt cancellation by securing debt relief for victims of for-profit colleges and disabled borrowers. We have secured critical policy wins along the way including: stopping student loan interest rates from increasing, expanding consumer protections for borrowers, and passing state legislation.

We have successfully engaged three presidential administrations, congress, and state legislators to address this crisis by shifting the narrative to include broad-based debt cancellation by securing debt relief for victims of for-profit colleges and disabled borrowers. We have secured critical policy wins along the way including: stopping student loan interest rates from increasing, expanding consumer protections for borrowers, and passing state legislation.